Contents:

FXCM Markets is not required to hold any financial services license or authorization in St Vincent and the Grenadines to offer its products and services. Since its 1999 inception, the EUR/GBP has gone through several periods of prolonged volatility. The above figures are for illustrative purposes only and do not constitute actual prices. Trade your opinion of the world’s largest markets with low spreads and enhanced execution.

What is Eurusd correlated with?

For example, EUR/USD and GBP/USD are often positively correlated because of the close relationship between the euro and the British pound – including their geographic proximity, and their status as two of the world's most widely-held reserve currencies.

+1 refers to a fully positive correlation, which indicates that the price of two currency pairs is highly likely to move in the same direction in the long run. When employing currency pair correlations, you have the opportunity to double down on trades, maximizing your earnings. Frequently, the EURUSD and GBPUSD pairs exhibit a high correlation. Therefore, due to leverage, going long on the two pairings will result in more earnings.

For instance, you can take out a lengthy and high position or place on USD/CHF to hedge any type of losses that you meet on an active high position of EUR/USD. It is because these pairs of currencies own a powerful historical correlation that is negative. You could also make a trade on correlations of forex pair to hedge your risk within your currency trades that are active. If there is a negative correlation between AUD/USD and USD/CAD, possessing a lengthy position on both the pairs will cancel each other out effectively.

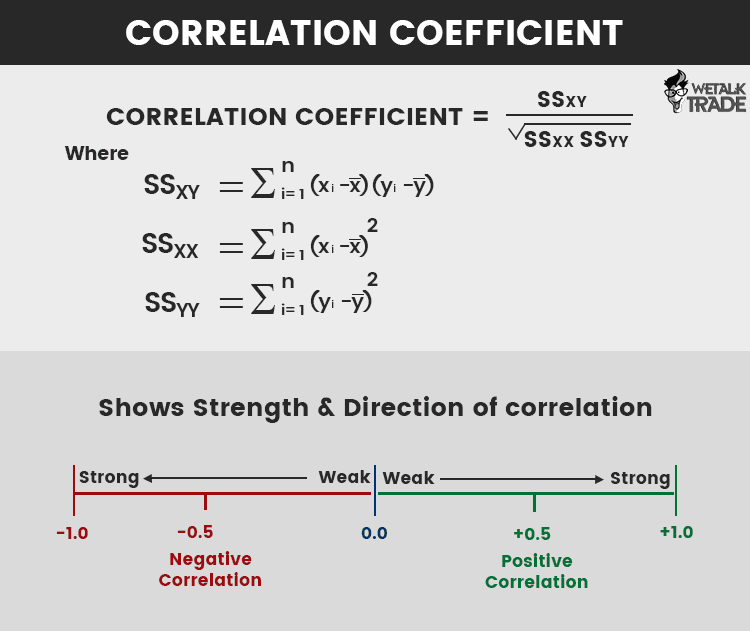

In forex, the value of the correlation coefficient ranges from -100 to 100. When two currency pairs have a positive correlation, they are positively impacted by each other and move in the same direction. The correlation of currencies allows for better evaluation of the risk of a combination of positions. Correlation measures the relationship existing between two currency pairs. For example, it enables us to know whether two currency pairs are going to move in a similar way or not. The forex open position ratio is something which is held by a trader in respect of all major currency pairs.

Est. Share Price

The AUD has grown in popularity over the past few years since it tends to have a higher yield than many other currencies in the developed markets, making it attractive for traders looking for yield. Additionally, it also tends to attract attention because of its strong links to commodities, as Australia is a large commodity exporter, and consequently their growing trade relations with Asia. As such, the AUD is also known as one of the major commodity currencies. When oil prices fall, the Canadian dollar falls too, which causes USD/CAD to rise.

They are not fully independent since the pairs move in the same direction. Depending on your risk appetite and rules of risk management, currency correlations can double both the profit and the loss on retail investor accounts. For example, you risk 5% of your deposit and open trades in the positively correlating pairs EUR/USD and EUR/GPB. In this case, the total risk for these two trades will not be 5%, but rather 10%. Let’s look at an example of such currency pairs like EUR/JPY and AUD/JPY . Its strengthening on the market will lead to the euro and the Australian dollar moving in the same direction synchronously.

In case the value date falls on a holiday, the position is rolled to the next working day, and the swap is charged for a few days in advance. Unlike the stock market, foreign exchange does not offer traders opportunities to diversify their portfolio. The long position on EUR/USD, GBP/USD and short on USD/JPY and USD/CHF give the trader about the same exposure because he is profiting from the weakening of the U.S. dollar. Currency pairs are moved by a variety of factors such as Interest rates, inflation, governmental policies, and political stability are just a few to name.

How to Use Correlations to Trade Forex

When trading any currency pair via forex brokerage houses, it is ideal to follow the economic news so you don’t miss any event that could drive a major price change. This applies as well for the EUR/GBP currency pair; besides, EU countries and the UK are involved. When it comes to trading forex pairs, there’s always a base and quote currency. The pair results from a price comparison of the base and quote currency, which indicates the needed amount of the quote currency for buying the base currency. The yen is the third most traded currency in the world, and its value often moves in tandem with the price of gold.

In this case, after selling the goods in the U.S., the investor will receive more euros than expected. If the EUR/USD goes up , the producer will suffer losses because he will receive less EUR, than planned. Similar to other markets, the currency market’s participants are broadly divided into speculators and hedgers. Whereas speculators profit from the price changes, hedgers, on the other hand, are indifferent to changes in price because they own the physical assets. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice.

How can negatively correlated pairs be used for trading?

Markets with the Canadian dollar as the base currency will have a positive correlation instead. The other reason is that currency pairs are priced different than equities and bonds. The USD/JPY trades between 0.03 and 0.04, and the USD/CAD trades between 0.02 and 0.03. The more political uncertainty, the more the price of a currency pair will fluctuate. For example, political uncertainty could raise the US dollar price against the euro. A correlation coefficient represents how strong or weak a correlation is between two forex pairs.

Pound Euro Exchange Rate News: GBP/EUR Wavers amid HSBC … – TorFX News

Pound Euro Exchange Rate News: GBP/EUR Wavers amid HSBC ….

Posted: Mon, 13 Mar 2023 10:18:14 GMT [source]

Then, losses in your Eurodollar position may be offset by gains in the Swissie trade. Markets with positive correlation will experience similar movements. If one goes up, the other should go up too In our example above, EUR/USD and GBP/USD are positively correlated, as they’ll both experience the same outcome when USD moves. USD/JPY, on the other hand, would move in the opposite direction – so it is negatively correlated to both EUR/USD and GBP/USD. Forex correlation is a measure of how much the movements of currency pairs are affected by each other.

How some traders magnify their risk exposure without knowing it

Nowadays traders do not have to necessarily know how to calculate currency correlation. Many trading platforms and Forex news websites provide this type of information. For example, this Forex correlation table was constructed, using the numbers from the Forex correlation calculator https://day-trading.info/ at investing.com. Average True RangeAverage True Range helps in identifying how much a currency pair price has fluctuated. This, in turn, helps traders confirm price levels at which they can enter or exit the market and place stop-loss orders according to the market volatility.

In fact, they were the first financial institutions to introduce inflation targeting. It eventually paid off with the latest figures pointing at only a 1.9% CPI increase during the last 12 months. That seems strange, considering that half of state budget revenues in Russia come from the energy sector. For several decades now, the entire economy of this country has been heavily dependent on this commodity. This is just another example, confirming the savvy trader should not always trust the past market patterns during the decision making.

But also, during times of economic unrest, or when inflation expectations are rising rapidly , investors dump the greenback and risky assets, in favor of Gold. So, the correlation between Gold and the US Dollar changes depending what is debt finance definition and meaning on the drivers because they are two “defensive” instruments. -1 refers to a fully negative correlation, which indicates that the price of two currency pairs is highly unlikely to move in the same direction in the long run.

In perfect correlation, the two currency pairs are most likely to move in the same direction. When the correlation is a perfect negative, the two currency pairs will move in different directions. The following table is an example of an automated correlation table. The two trades would effectively cancel each other out, due to the negative correlation exhibited by these two pairs. Margin trading involves a high level of risk and is not suitable for all investors. Forex and CFDs are highly leveraged products, which means both gains and losses are magnified.

Is NZD correlated with commodity prices?

Access our latest analysis and market news and stay ahead of the markets when it comes to trading. The correlation coefficient highlights the similarity of the movements between two parities. Futures trading is one of the earning options available on today’s financial markets and possessing a number of its own peculiarities. If you wonder how you can earn from trading futures at Forex, you’ll find the answer and the underpinnings of futures operations in this article. When calculating the profits and the deposit required to maintain the position, the feasibility of trades of this kind remains a big question.

- For example, traders can open positions with two negatively correlated currencies in an effort to reduce risk.

- She has 20+ years of experience covering personal finance, wealth management, and business news.

- Any sudden shift in one of the positively linked pairings will almost certainly be mirrored in the other.

- A currency either has high volatility or low volatility depending on how much its value deviates from its average value.

- This is often reflected in the movements the USD/CAD pair because oil is traded in the US dollar, which is generally negatively correlated with the price of oil.

- In order to get a better understanding of the currency correlation meaning, it can be helpful to turn to some practical examples.

It is very important to understand how currency pairs move in relation to one another. This will help you understand the exposure of each trade that you enter. Some pairs move in tandem with one another while others move in direct opposites. Calculating the correlation between currency pairs might seem difficult. One example of this might be the performance of the British Pound during and after the 2016 EU referendum. We have already discussed that EUR/USD and GBP/USD have a very high correlation coefficient.

Is there a correlation between Gbpusd and Eurusd?

That is a perfect positive correlation. The correlation between EUR/USD and GBP/USD is a good example—if EUR/USD is trading up, then GBP/USD will also move in the same direction. A correlation of -1 indicates that two currency pairs will move in the opposite direction 100% of the time.

In the EURGBP forex rate, the EUR is the base currency, while the GBP is the quote currency. This means that at any given time, the price of EURGBP pair represents the amount of British pound sterling it would take to exchange for one euro. Some currency pairs move in the same direction, and some in the opposite. Statistically, this relationship is called the correlation and is measured from -1 to +1.

Is GBP and EUR correlated?

In comparison, the GBP/USD and EUR/GBP have a strong negative correlation at -90, meaning they move in opposite directions much of the time.

As previously mentioned, this would be effective if the price of EUR/USD fell by a certain amount per point, but USD/CHF increased for a certain amount per point. In this, the gains on the USD/CHF long position would offset the losses on the EUR/USD position. No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination.

Is GBP and EUR correlated?

In comparison, the GBP/USD and EUR/GBP have a strong negative correlation at -90, meaning they move in opposite directions much of the time.